Investment Boutique Premium

In the debate between active and passive management, which has intensified in recent years, the outperformance of Independent Investment Boutiques has been overlooked.

Investment Boutiques are defined as firms that have less than $2 billion under management where the managers own more than 50% of the equity in the firm, and the investment strategies are specialized.

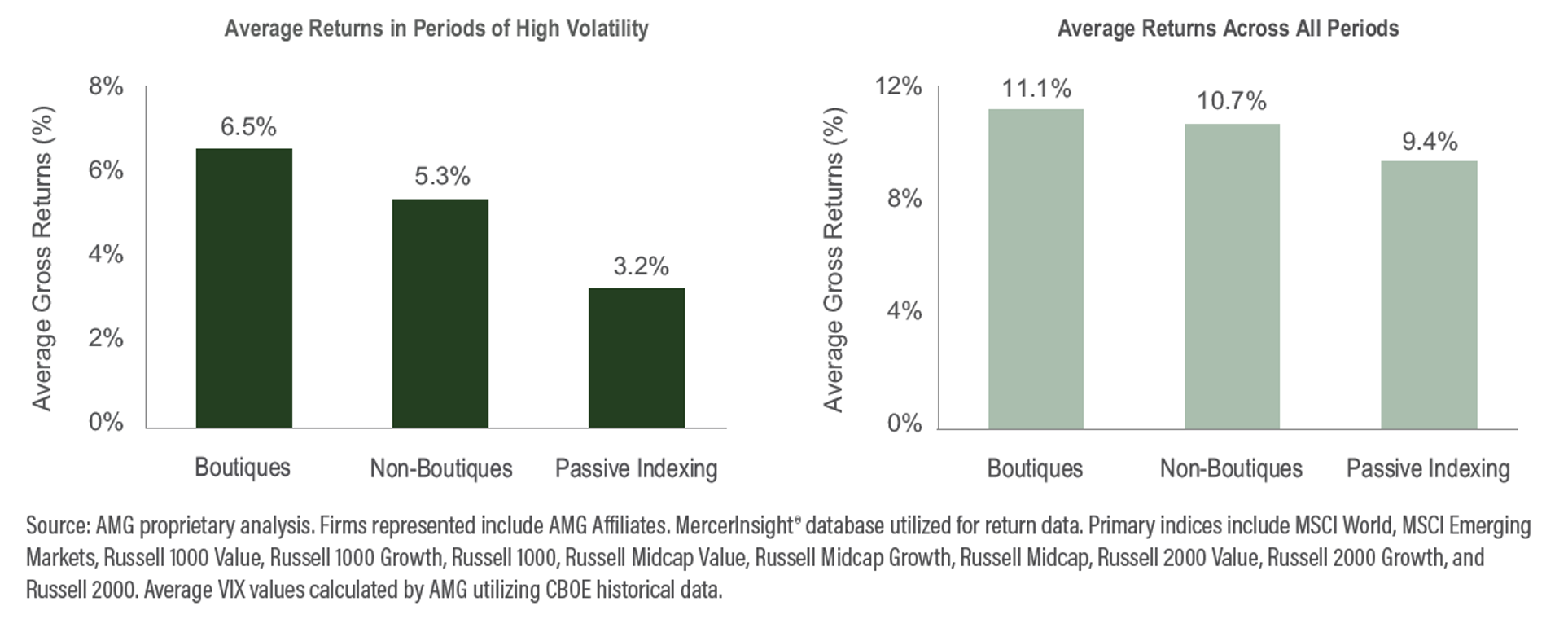

A study by Affiliated Managers Group found that these firms outperformed both their investment peers and the passive indexes for the twenty-year period from 2000-2019. Boutiques generated gross annual returns during the period of 11.1% versus 10.7% for non-boutiques and 9.4% for passive indexes, with additional outperformance during high volatility periods as seen in the chart below. The findings included more than 1,300 individual investment management firms and nearly 5,000 institutional equity strategies encompassing nearly $7 trillion in assets under management.

20-YEAR AVERAGE GROSS RETURNS FOR INDEPENDENT BOUTIQUES, NON-BOUTIQUES AND PASSIVE INDEXING

The research identified several core characteristics among the boutiques that imply inherent competitive advantages in producing higher investment performance. Following is a summary:

(1) Outperformance during more volatile periods illustrates the benefit from being nimbler with less bureaucracy than peers, thus allowing them to take advantage of larger swings in securities prices driven by the heightened volatility. In a 2014 study by Wealth Management.com, 80% of advisor respondents saw boutiques as highly agile compared to viewing just 35% of the larger firms they use as agile.

(2) Typically, due to smaller staffs, a client has direct access to the manager in an investment boutique, which can increase comfort during volatile periods by clearly understanding the investment philosophy and portfolio positioning. This helps clients avoid emotional mistakes by providing a first-hand tour of the portfolios.

(3) Portfolio managers have higher equity ownership than the typical portfolio managers at larger firms, which better aligns interests with clients as well as an investment driven and entrepreneurial culture which attracts talented investment personnel with higher incentives dependent on performance.

(4) Factors that contributed to higher outperformance during heightened volatility were more resilient returns during downturns than non-boutiques and passive indexes and higher outperformance than non-boutiques in the recoveries immediately following the downturns.

(5) Of great importance, boutiques were found to have investment-centric organizations with alignment typically geared to a specific investment philosophy with a highly focused investment process.

Boutiques are built on the high conviction belief that they can deliver solid and consistent risk-adjusted performance over the long term by employing well defined, distinct, and repeatable investment processes. Some remain first-generation owned and operated businesses where the founder remains personally involved, taking pride in the business and its reputation.

The end result is a culture driven by the investment process versus asset gathering which, overall, led to higher investment results from 2000-2019 according to the study. Many sophisticated investors and advisors are becoming aware of this premium and are implementing barbell strategies where they complement core passive strategies with allocations to active equity and alternative strategies managed by boutiques.

Mr. Nowell has over 39 years of experience in the finance business. Prior to founding South Atlantic Capital, he worked in the leveraged lending department of Bankers Trust Company, New York as an Assistant Vice President. His primary responsibility was arranging bank financing for leveraged buyouts led by Kohlberg, Kravis, Roberts & Company and other leading private equity companies. During graduate school he interned with Merrill Lynch’s Capital Markets Group in New York. Later he served as an institutional fixed income salesman for Carolina Securities/Prudential Bache Securities and worked with Fox, Graham, and Mintz Securities. Mr. Nowell graduated from the University of North Carolina with a B. S. in Economics and received his MBA from the University of Virginia.

Disclaimer: Past Performance is no guarantee of future results. Nothing in this article should be construed as investment advice of any kind. Consult your investment adviser before making any investment decision.